🎉 Tillful is now part of Nav! Compare business credit cards at Nav

How To Apply For a Business Credit Card

Interested in getting a business credit card for your small business or startup? Smart move. They often come with great perks and can grant you more financial flexibility.

But how can you apply and get approved? Do you need several years in business and millions in revenue? Definitely not! Here’s all you need to know about getting a business credit card. Plus, learn how to find the best credit cards for your unique business needs.

How to apply for a business credit card

The process of applying for a business credit card is pretty simple and straightforward. Most credit card companies that offer business credit cards — like Chase, Capital One, and Bank of America — have convenient online applications. You can go to their websites, enter the required details, and get an answer within a few minutes. If approved, you’ll usually receive your card in the mail within a week or so. The trickier part, however, can be getting approved and finding the best card for your business.

Business credit card eligibility requirements

Most business credit card issuers require one of the business owners to provide a personal guarantee in order to get approved. That means the business owner is personally responsible for the debt if the business can’t pay it. Being so, you won’t necessarily need to have business credit established to get approved but you will need to have a qualifying personal credit score. Further, your credit history can’t have any information that throws up red flags for lenders (more on that below).

What personal credit score is required for a business credit card?

In most cases, you’ll need to have a personal FICO score of 670 or higher to get approved for a business credit card. According to Experian, scores of 670 or higher are considered “good.” That said, the credit score requirements can vary by lender.

To figure out where your personal credit score stands, you can check your credit once per year for free. If you’d like to keep closer tabs on it, you can also sign up for credit monitoring with a company like Experian to CreditKarma.

What information is required on a business credit card application?

What can you expect from a business credit card application? Here’s the key information that’s typically required:

- Name of your business

First is the legal name of your registered business. If you run a sole-proprietorship, you can enter your legal name.

- Business contact information

Next is your business address and phone number. If you work from home, you can enter your personal address and phone number. - Industry type

You’ll also need to select the industry your business falls under or the one that most closely applies to your business. - Business type

There are many types of businesses such as corporations, partnerships, limited liability companies, sole proprietorships, etc. You’ll need to share what type you are. If you’re registered as a partnership or corporation, you may be asked to list basic information about the business owners. - Employer identification number

Add your employer identification number (EIN) which is used to verify your business. If you’re a sole proprietor without an EIN, you can provide your social security number (SSN) instead. - Years in business and number of employees

Share how long the business has been in operation and the number of employees that are part of the company. - Annual business revenue

The lender will also want to know how much gross annual revenue your business brings in each year. Ensure this number is not exaggerated as you will likely be requested to provide supporting documentation to verify its accuracy. - Personal information

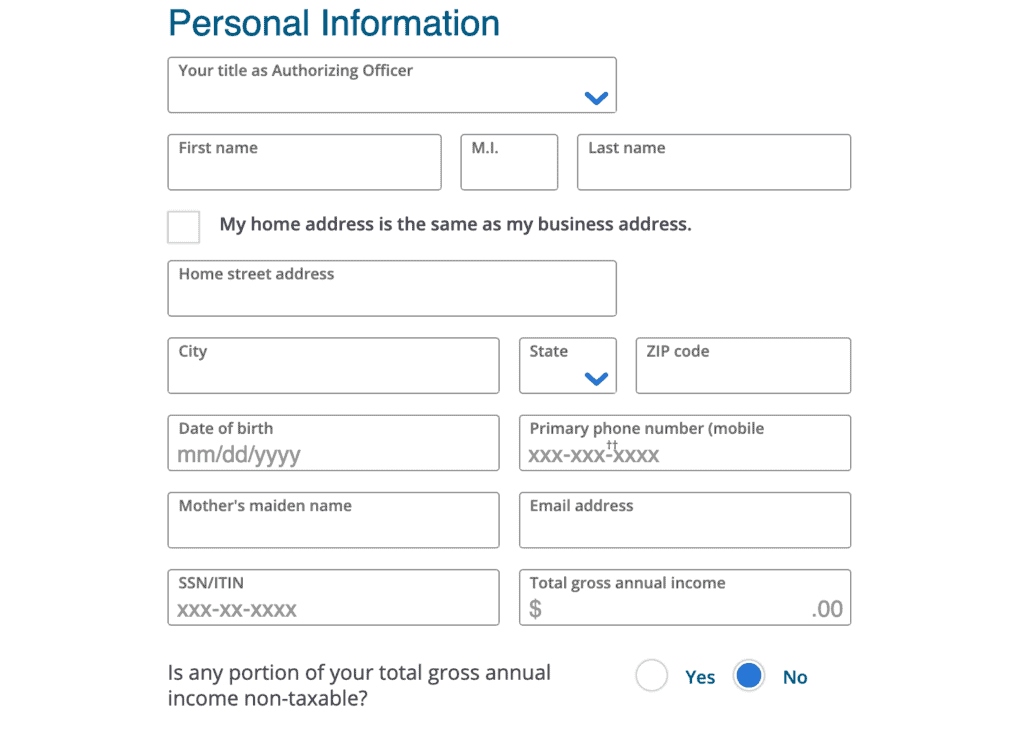

Last but not least, you’ll need to provide your information for the personal guarantee. This section often requests your title, name, address, birthday, phone number, total annual income, and social security number.

That’s it! From there, you typically e-sign a disclosure and consent for electronic communications, then can submit your application. You’ll usually get an answer immediately, or within a day.

How to find the best business credit cards for you

Once you decide you want to get a business credit card, it’s important to do a bit of research to find the best card options for your business needs. But what should you look for? Here are a few of the key factors to consider:

- Eligibility requirements: Check to see what eligibility requirements the credit card issuer has in place so you can decide if you’re likely to qualify. For example, certain cards will be better for startups or businesses with bad credit.

- Reporting: Find out if the card issuer reports to the consumer credit bureaus (Equifax, Transunion, and Experian), business credit bureaus (Equifax, Experian, and Dun and Bradstreet), or both. You’ll want to ensure you’ll be building business credit so the card issuer needs to report to the business credit bureaus. Additionally, you may prefer that the business card is or isn’t reported on your personal credit report.

- Card type: Cards come with different credit card processing networks (e.g. Visa, Mastercard, Discover, and American Express cards). One may be better than another based on your planned use. For example, if you travel, you may want a Visa or Mastercard as they’re more widely accepted.

- Fees: Find out how much the card will cost you. For example, some cards come with annual fees, balance transfer fees, foreign transaction fees, and more.

- Annual Percentage Rate (APR): The variable APR on offer will determine how much you pay on any outstanding balances you carry. The lower, the better.

- Rewards: Many card providers offer rewards that give you something in exchange for your eligible purchases. These can add up and provide meaningful savings for your company. For example, travel rewards cards often offer miles each time you swipe the card which can be redeemed for flights. The rewards may also come in the form of points or cash back.

- Benefits: Look for other perks that come with the card like travel insurance, free access to airport lounges, and extended warranty protection on your purchases. Also, be sure to read what terms apply.

- Introductory offer: Many cards entice cardholders with great introductory offers. For example, credit card companies may offer bonus points or statement credits if you spend a certain amount in the first few months. On the other hand, some offer introductory APRs during the first calendar year. These offers can help you boost your ROI on the card right off the bat so are worth considering. However, don’t let them blind you from the long-term costs.

The best business credit card for you will be a good fit for your business while offering the most bang for your buck. First, you’ll need to meet the qualification requirements. Beyond that, when considering the rewards, benefits, and costs, the card should come out ahead of the rest based on your unique business needs.

3 benefits of having a business credit card

Is a business credit card right for you? Here are a few of the main benefits to consider.

Keep personal and business expenses separate

Ideally, there should be a distinct line of separation between personal and business expenses. When tax season comes knocking, you’ll thank yourself (and your accountant will thank you). More importantly, doing so protects your personal finances from scrutiny should any legal trouble arise from doing business.

Build business credit

Business credit cards can also help you build a business credit history that is separate from you as the business owner. As you make payments on time, they’ll be reported to the business credit bureaus. An account linked to your EIN will begin to show a positive line of credit which will end up earning you a business credit score. This will establish your company’s creditworthiness in the eyes of lenders which can help you get business loans in the future that don’t rely on your personal credit.

Earn and gain perks

Another great benefit of using business credit cards is the reward programs they offer. They give you the chance to earn rewards for the frequent purchases your business makes. These rewards can be in the form of travel miles, cash back, points, and more.

As you can see, business credit cards can be great tools to help small business owners grow. Plus, they can open up more financing opportunities in the future.

When you may want to wait to apply for a business credit card

What if you currently have fair credit, no credit, or bad credit? If your personal credit score isn’t quite 670 yet, it can make sense to wait to apply for a business credit card. Additionally, while your credit score is a big factor, lenders will also look at your personal credit history as a whole. You may get denied if they find:

- Bankruptcy: You have a bankruptcy on your credit report.

- High DTI: If your debt-to-income ratio is above 43%, lenders may see you as nearing unmanageable levels of debt.

- Limited credit history: You haven’t had any credit lines open for more than a year.

- Missed payments: You’ve missed payments on other open credit lines.

- Low income: Your income level isn’t high enough to qualify for the card.

- Too many recent accounts: You’ve opened too many credit accounts recently which makes you appear high risk.

If you have any of these marks on your credit report or reveal them in your application, it may be better to wait a bit and work on improving your credit profile. Lenders will hesitate to lend to you if you’ve shown any signs that you can’t meet your current obligations.

Quick tips on how to raise your credit score

How can you give your personal credit score a boost so you can get approved for a business credit card sooner rather than later? While making on-time payments has the biggest impact on your credit score, it’s something you need to do consistently over time. It won't be a quick fix. Here are a few other ideas that can have a quicker impact.

Reduce your credit utilization ratio

If you have credit cards with outstanding balances, one of the quickest ways to boost your credit score is to pay them off and request higher spending limits. Credit utilization is the second most impactful credit score factor, impacting up to 30% of your score, according to Experian.

Fix errors

Another important step is to make sure that there are no errors in your credit report. Review all of the information to ensure it’s accurate and within the allowed window for reporting. After seven years, many items should drop off. If you have old delinquent marks on your report that should be gone or erroneous information, file a dispute to get them removed.

Become an authorized user

You can also request to be added as an authorized user on the account of someone with good credit. By doing so, you can piggyback on their good credit as their account will show up on your report.

Open a secured credit card

If you don’t have any credit yet, you can get started with a secured credit card account. You’ll have to put down a security deposit to gain access to the credit line. However, then you can start to build a positive credit line on your report. Within a few months of on-time payments, card issuers often increase your credit line without requiring an additional deposit.

Settle collections accounts

Lastly, if you have any open collections accounts on your report, contact the creditors to settle them. The accounts will look better to future creditors if they are paid rather than owed. Plus, it removes the risk of you getting sued.

If you’re having trouble getting approved for a business credit card account with a personal guarantee, you can also consider a secured business credit card that won’t rely on your personal credit. There aren’t many but there are a few! For example, the Tillful Card doesn’t require a personal guarantee and is designed to help companies without much credit start building their business credit profiles.

Final tips for using a business credit card effectively

The key to using a business credit card to your greatest advantage is paying it off each month in full. When you don’t let your balance carry over beyond a billing cycle, you’re not charged any interest. As a result, you minimize your costs but can still earn rewards on your spending and take advantage of all the card’s benefits.

If you receive an introductory 0% APR period, it can make sense to carry a balance. But be sure you pay it off before the normal APR kicks in or interest charges can be retroactive. Additionally, there may be times you need to carry a balance for a few months, but you shouldn’t make it a habit. Try to keep the balance between 0% and 30% of your total spending limit at all times.

By managing your card responsibly over time, you can grow your business credit and open up more financing doors for your company in the coming years!