🎉 Tillful is now part of Nav! Get your business credit score at Nav

Looking to learn the ins and outs of Experian business credit scores? We’ve got you covered. Experian is well known in the U.S. as a consumer credit reporting company, but it also collects information on millions of businesses and provides business credit reporting services.

Building a good business credit score with Experian can open many doors like helping your small business get approved for a lease and earning you competitive business loan offers. So where do you start?

📲 Tillful x Experian Partnership

The Experian business credit score is now in the app and Tillful dashboard! You can download the Tillful iOS app to check if your company has a credit profile with Experian. If you do, you can access your Experian credit score through Tillful at no extra cost. If you don't yet have a credit profile with Experian, then you can request to file establish directly. Learn more about Experian and Tillful partnership and see how it works ⮕

Here’s all you need to know about Experian’s business credit score, how it works, and where to find yours.

What is an Experian business credit score?

Experian provides business credit scores designed to predict the likelihood that a business will have serious credit delinquencies in the next year. Similar to how personal credit scores are used, third parties like lenders look to business credit scores to figure out how much credit risk a business presents. As a result, your business’s score can impact whether you can get loans and credit lines along with the rates and terms you’ll receive on them.

What is a good Experian business credit score?

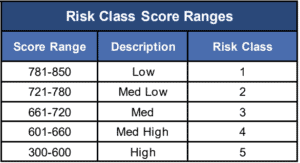

The Experian business credit score is called Intelliscore Plus. Currently, the scoring range is 300-850, with 850 being the highest score.

The higher your score, the lower the risk you present. That said, scores of 781 and higher are considered good as they mean your risk level is lower than average.

Experian’s business credit reports also feature a financial stability risk rating which aims to predict the likelihood of a bankruptcy or payment default in the next year. The scores range from one to five but, unlike the business credit score, a lower score indicates lower risk.

The chart below shows the correlation of both scores and the risk description for each score range. Plus, you’ll find the percentage of businesses in each score range that get what’s considered a bad interest rate on credit products (common with merchant cash advances). The higher your score range, the more likely you are to get good rates, which are usually 10% APR or less.

How do you know if you have an Experian business credit score?

If you’re wondering if you have a business credit score with Experian, follow these steps to find out.

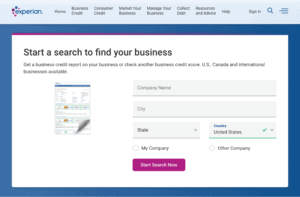

1. Visit Experian’s Business Credit Report page, scroll to the section where you can enter your business information, fill out the form, and perform the search.

2. Once you enter your details and press the “Start Search Now” button, Experian will search its database for your company. If you have a credit report, your business name and address will appear at the top of the page and the report options will be listed below it.

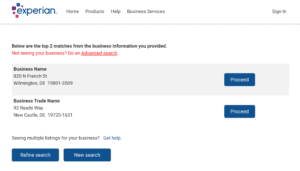

3. If Experian doesn’t have a credit report on file for you, you’ll see the top two search results most similar to your search and will have the option to perform a more advanced search.

💡 Pro Tip: To get an accurate result, it’s important that you spell your name and address correctly and write them as they appear on your official business records.

4. The refined search has additional input fields which can help you to locate your business if you haven’t been able to do so yet.

Experian’s online business search tool is a quick and easy way to see if your company has a business credit report on file. However, if you have trouble, you can also contact the company’s customer service department via online form or by sending an email to customer service.

How to get an Experian business credit report

Unlike with consumer or personal credit reports, you are NOT entitled to free copies of your business credit reports each year. Instead, business credit reports typically come with a cost. With Experian, you can get your report online by going to the company’s website and following the steps shown above.

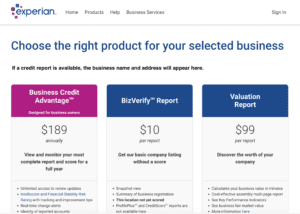

If your report is available, you have a few purchase options.

- CreditScore Report: Pay a one–time fee of $39.95 for your business credit report.

- ProfilePlus Report: Pay a one-time fee of $49.95 for a copy of your business credit report that includes additional information including your trade payment details, inquiry details, Uniform Commercial Code (UCC) details, and corporate financial information.

- Experian’s Business Credit Advantage plan: Subscribe to a $189 annual plan that lets you view and monitor your business credit report and score for a year.

Experian also offers a BizVerify report for $10, but it doesn’t show you any of your business credit information. Instead, it’s just a summary of your business registration. Additionally, a valuation report is available for $99 that calculates your business’s value and features key performance indicators. However, it also won’t show you your business credit file or score.

Experian business credit score factors

When analyzing your business, Experian considers many factors including your credit history, public records, and company demographics. Here’s a closer look at each.

Credit

When it comes to credit, Experian looks at the number of trade accounts you have, your payment history, your outstanding balances, how much of your available credit is used, and your payment trends over time. On-time payments, low credit utilization, and lengthy positive track records will all work in your favor.

Public records

Your score will also reflect the risk generated by public records such as liens, judgments, collections, and bankruptcies. These show that payment obligations were not met so will cause your score to drop.

Demographics

Certain demographics and background information of your business will come into play such as the number of years you’ve been in business and the size of your business.

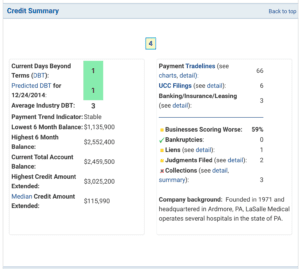

Wondering how these factors are presented? Here’s a credit summary from a sample Experian business credit report:

Keep in mind that the information included on your business credit report from Experian will vary depending on the report type you purchase.

How to raise your Experian business credit score

To improve your business credit score with Experian, you’ll need to demonstrate stability and financial responsibility over time. How? Here are some guidelines to keep in mind:

- Open business credit accounts (also known as tradelines). To demonstrate your creditworthiness, you need to open business credit accounts (such as credit cards), meet your obligations, and ensure that information is reported to the business credit reporting agencies. Be sure to look for lenders that report data to Experian.

- Pay late payments ASAP. If you’re late on a payment, make it as soon as possible because late payments are categorized by how late they are (e.g. 30 days, 31-60 days, 61-90 days, 90+days).

- Avoid bankruptcies, liens, collections, and judgments. If you owe a person or entity money, be proactive about coming to a resolution about the debt. If you do have a lien, account in collections, or judgment, settle it as soon as possible.

- Be selective when taking secured loans. Loans secured by your accounts, accounts receivable, contracts, etc. require UCC filings and one or more can be a red flag that hurts your score.

- Keep tabs on your report. Monitor your report and make sure there are no errors. If you have made a financial misstep, it should fall off the report in time which will help your score to increase. Bankruptcies stay for nine years and nine months, while collections, judgments, and liens stay for six years and nine months.

- Don’t apply for too much credit. Credit inquiries are tracked and too many are a sign of financial distress which will hurt your score. Plus, overextending yourself could lead to collections, which contribute to a lower credit score.

- Stay in business. The longer you are in business, the more stable and trustworthy you will seem.

- Don’t max out your credit lines. Credit utilization is a factor and the less available credit you use, the better. Maxing out all of your available credit is a signal that you’re in financial trouble.

Earning a good business credit score with Experian comes down to demonstrating over time that you can manage your credit and finances well. In doing so, you’ll ease the concerns of future lenders which will help you earn more borrowing power with better rates and terms. Plus, you’ll do a lot to boost your business’s financial health. However, Experian isn’t the only company that rates business credit so be sure to also keep tabs on your Dun & Bradstreet and Equifax business credit scores.