What is a HUBZone?

U.S. venture capital blew past $300 billion for the first time ever last year. However, most of that funding is concentrated within the nation’s biggest metropolises (think San Francisco, New York City, and Boston). That’s one of the many factors that leaves small businesses to depend on government contracts.

U.S. small businesses can use a program called HUBZones (historically underutilized business zones). The U.S. Small Business Administration (SBA) created HUBZones in 1998. The goal? To help small businesses in certain communities gain access to federal contracts.

These federal contract opportunities run the gamut, ranging from HVAC design-builds and elevator modernization to cosmetology instruction and custodial services. (There are literally thousands of opportunities waiting for small businesses to snap them up!)

Here’s the scoop on the HUBZone program, including who it serves and how small businesses can apply.

Definition of the historically underutilized business zone

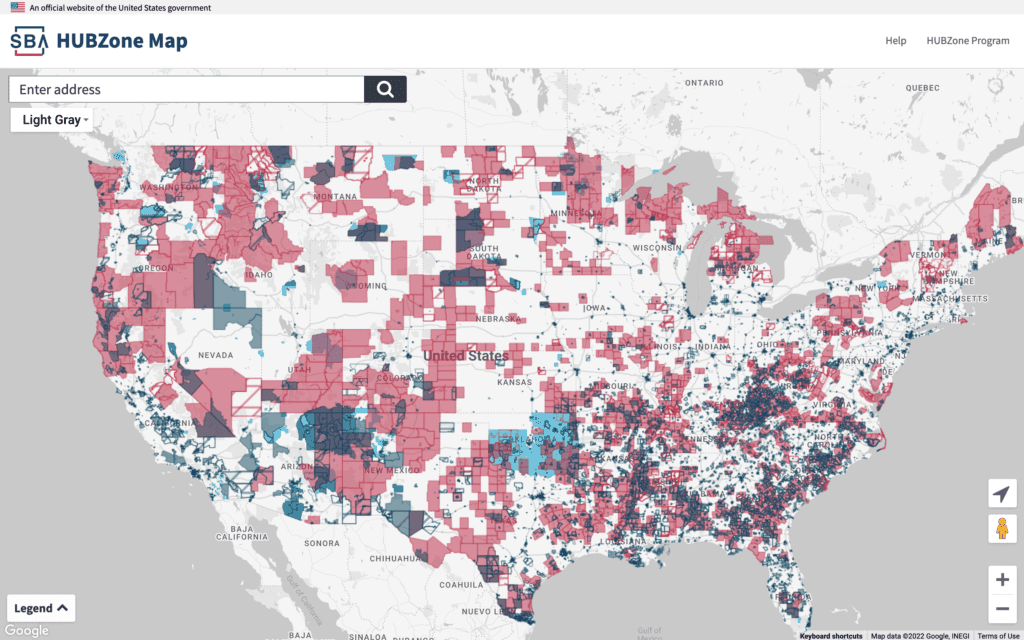

The SBA first created HUBZones to help “small businesses in rural communities gain preferential access to federal procurement opportunities.” Today, the definition has expanded to include both rural and urban communities. For example, large portions of Miami, Baltimore, Los Angeles, and Oakland are eligible according to the HUBZone map.

These small businesses must adhere to certain qualifications. The main rules are that they must be located in one of four HUBZone designations:

- A qualified census tract

- A qualified county with median household income below 80% of the state’s median—or an unemployment rate of at least 140% above the state average

- Lands in boundaries of federally recognized Indian reservations

- A qualified base closure or disaster area

Who do HUBZone programs serve?

The HUBZone program serves small businesses in economically distressed communities. In general, the SBA defines a small business as one with less than 500 employees. The administration also sets some industry-level standards depending on the sector.

HUBZones provide for these businesses by giving them access to federal contracts. The SBA sets aside 3% of federal contract dollars for HUBZone-certified companies each year. This funding isn't automatic. These small businesses still have to apply for the program and bid for contracts.

“While federal procurement has not yet reached the 3% goal established for the HUBZone program, there has been a steady increase in awards going to HUBZone firms for the past few years.” - Tiffani Clements, public affairs specialist of SBA

In FY 2020, more than 26% of federal contract spending went to small businesses. That surpassed the federal government’s small business contracting goal of 23%.

Despite exceeding goals, small business funding is still imperfect. During this time, agencies “fell short on prime contracting goals for women-owned small businesses and HUBZone small businesses,” according to the Federal News Network. President Biden ordered federal agencies to increase awarded contracts to small, disadvantaged businesses by 50% come 2026, making now a great time to take advantage of this pivoting market.

Though HUBZone contracting fell short, it still played a big role in extending contracting opportunities to small businesses. The SBA HUBZones program awarded $13.6 billion in federal contracts to more than 2,000 HUBZone firms in 2020.

FUN FACT: In the U.S., business ownership contributes more than a third of non-financial assets to a family’s wealth. More money in the hands of small businesses means helping close the wealth gap.

Through HUBZone, small businesses in historically underutilized areas can get major financial opportunities. U.S. law requires the federal government to consider buying from small businesses, which is why publicly listed contract opportunities are so important. HUBZones specifically target communities with high levels of unemployment and poverty, Indian territories, and regions impacted by military base closures and disasters.

Meaning and benefits of being a HUBZone-certified company

Small businesses can become HUBZone-certified to bid on federal procurement opportunities. Clements says, “Federal contracting is one way in which the government addresses diversity, equity, inclusion, and the wealth gap.”

After following the steps to become a HUBZone-certified business, eligible companies can get these key benefits:

- Gain access to different types of contracts. This includes competitive and sole-source set-aside contracts. It also includes prime contracts (where businesses work directly with the government instead of as a subcontractor).

- A 10% price evaluation preference in full and open contract competitions and in subcontracting opportunities. In competitive bids, companies can outbid large business competitors by no more than 10%. This gives small businesses a chance to get contracts for a lower, responsible offer.

What are the HUBZone program qualifications?

HUBZone-certified companies must be a small business according to SBA size standards. If you don’t know if you’re a small business according to the SBA, then you can check your business size here.

Your company must also be 51% controlled by any of the following:

- U.S. citizens

- A Community Development Corporation (CDC)

- An agricultural cooperative

- An Alaska Native corporation

- A Native Hawaiian organization

- An Indian tribe

And of course, the biggest part — your company’s principal office must be located in a HUBZone region. Plus, 35% or more of your employees must live in a HUBZone.

You can find more specific qualifications in the National Archives.

Did you know? Clements says that 67% of HUBZone-certified firms self-certify as a small disadvantaged business. And about 44% of HUBZone firms are dual-certified as Woman-Owned, Veteran-Owned, or 8(a) small disadvantaged businesses.

SBA’s HUBZone application process for small businesses

Before you apply for a HUBZone certification, follow the tips on www.SBA.gov. The administration lays out the details to prepare you for HUBZone contract procurement. The SBA also helps you determine eligibility and gather the documents you need to apply.

PRO TIP: Make sure you’re following criteria to the tee. Other contracting officers can protest contracts awarded as HUBZone small business concerns.

Businesses need a SAM.gov account and a General Login System account. Once you’re in the General Login System, follow the instructions to apply.

How long does HUBZone status last?

The SBA updates the HUBZone map every five years. According to Clements, the SBA will update the current HUBZone map on July 1, 2023 to reflect the 2020 Census results.

HUBZone companies must recertify each year to maintain status as a HUBZone business. Despite this extra step, the SBA wants to promote long-term community investment.

For small businesses that buy a building or sign a long-term lease of 10+ years, get this. You can maintain HUBZone status for up to 10 years—even if your principal office location is redesignated and no longer on the HUBZone map.

Last Word on HUBZones

Clements says, “The HUBZone Program is part of a larger effort to address equity through contracting.”

The HUBZones program does more than support economic development in certain HUBZone areas. It also helps close the wealth gap that underrepresented small business owners face. The U.S. is the largest purchaser of goods and services in the world. That’s why qualifying small businesses should apply for a HUBZone certification.

Get bidding on federal government contracts so you can grow your small business!